2023 payroll tax withholding calculator

Choose the right calculator. There are 3 withholding calculators you can use depending on your situation.

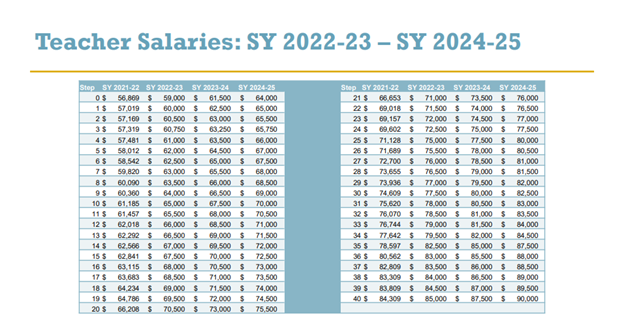

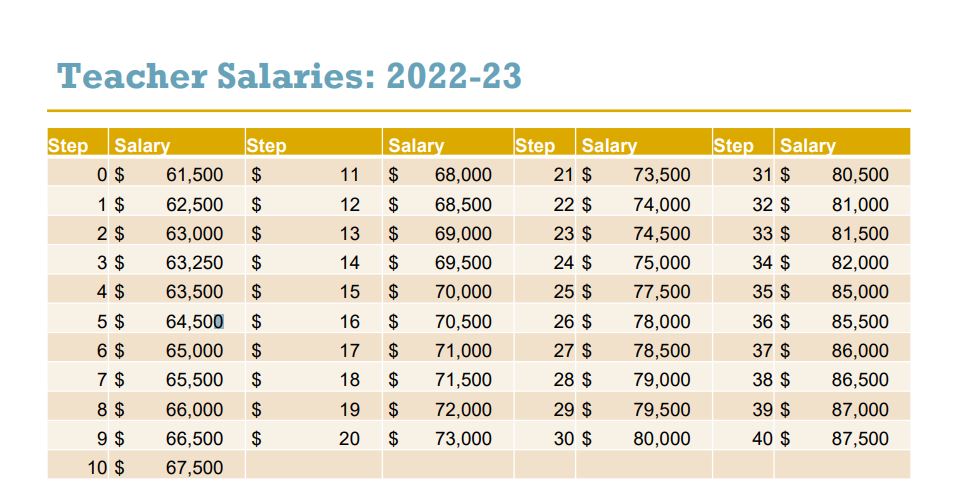

Hisd Announces Teacher Salaries Raises Through 2025 News Blog

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Continue if you wish to make. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

2022 Federal income tax withholding calculation. Prepare and e-File your. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Prepare and e-File your. Thats where our paycheck calculator comes in. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and.

Ad Compare This Years Top 5 Free Payroll Software. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. 2022 Federal income tax withholding calculation.

Subtract 12900 for Married otherwise. Estimate your paycheck withholding with our free W-4 Withholding Calculator. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Free SARS Income Tax Calculator 2023 TaxTim SA.

Tax withheld for individuals calculator. Prepare and e-File your. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS.

The Florida paycheck calculator can help you figure out how much youll make this year. Ad Compare This Years Top 5 Free Payroll Software. Based on your projected tax withholding for the year we can also estimate your tax refund.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of. All Services Backed by Tax Guarantee. Free Unbiased Reviews Top Picks.

Withholding schedules rules and rates are from IRS. Federal withholding calculator 2023 per paycheck Minggu 11 September 2022 Edit. Nanny Tax Payroll Calculator Gtm Payroll Services.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad See How MT Payroll Services Can Help Your Business. This calculator is integrated with a W-4 Form Tax withholding feature.

Start the TAXstimator Then select your IRS Tax Return Filing. Accordingly the withholding tax. Get Started With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. 2022 Federal income tax withholding calculation.

It will be updated with 2023 tax year data as soon the data is available from the IRS. The Tax withheld for individuals calculator is. Federal Taxes Withheld Through Your Paychecks.

Subtract 12900 for Married otherwise. Paycheck after federal tax. Calculate Your 2023 Tax Refund.

Subtract 12900 for Married otherwise. Calculates tax and salary deductions with detailed. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board.

Talk To A Professional Today. Salary Gross Tax NI NET Year 45000 6486. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

This calculator is integrated with a W-4 Form Tax withholding feature. The exception is where there is a pre-existing. Please see the table below for a more detailed break-down.

Get Started With ADP Payroll. Free Unbiased Reviews Top Picks. Learn More About Streamlining Your Employee Expense Reimbursement Process.

Ad Process Payroll Faster Easier With ADP Payroll. Wage withholding is the prepayment of income tax. It takes the federal state and local W4 data and converts it into a monthly weekly or.

2021 Tax Calculator Exit. Ad Process Payroll Faster Easier With ADP Payroll. Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount of.

2022-2023 Online Payroll Tax Deduction. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home. 2022 2023 Tax Brackets Rates For Each Income Level Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. It will be updated with 2023 tax year data as soon the data is available from the IRS. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

All Services Backed by Tax Guarantee. The Tax withheld for individuals calculator is. Enter the desired net pay in the field.

2022 2023 Tax Brackets Rates For Each Income Level

1120s Form 2022 2023

Estimated Income Tax Payments For 2022 And 2023 Pay Online

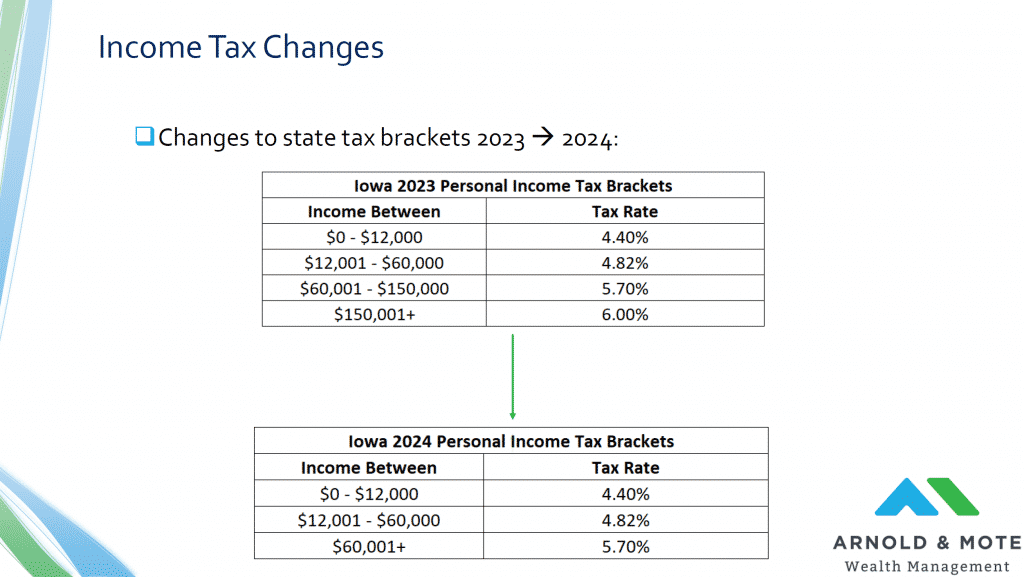

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Form 941 For 2023

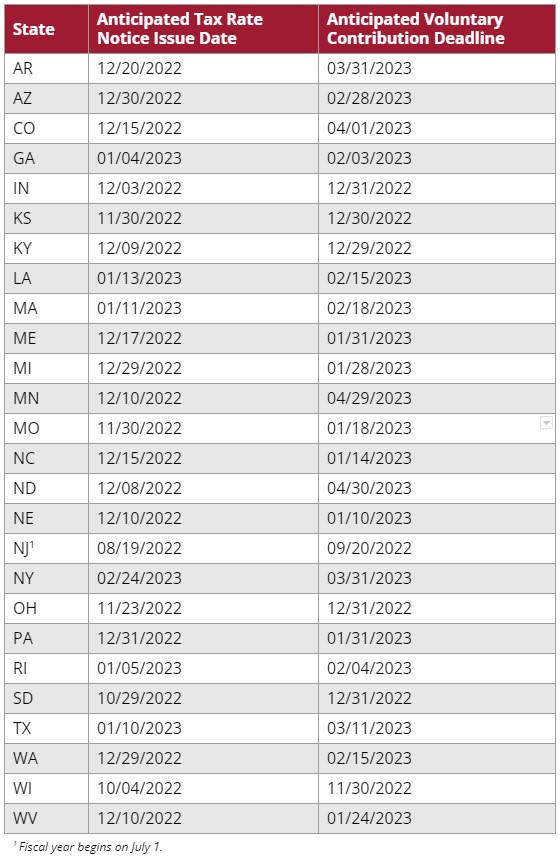

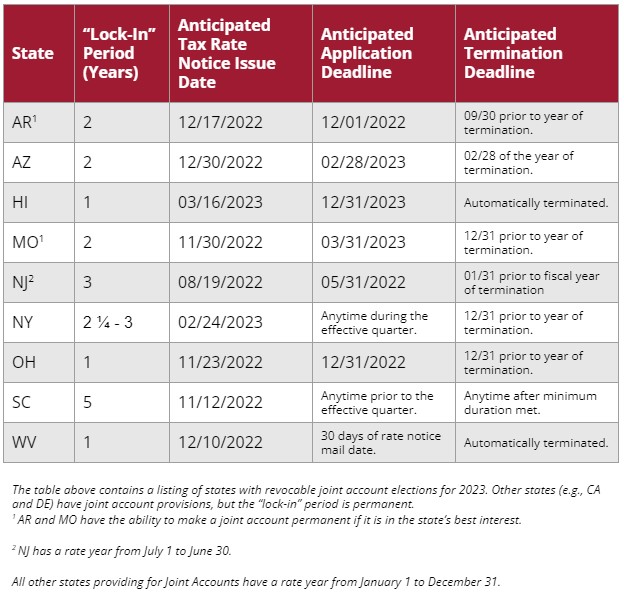

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Social Security What Is The Wage Base For 2023 Gobankingrates

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo